On March 10, 2000, the US stock markets began to fall. The tech-heavy NASDAQ suffered the worst losses falling some 78% from its lofty, exuberant highs in what became known as the euphemistically as the Dot-com Bubble. When looking back at the market of 2000-2002 in 2008 during the more aptly named Financial Crisis, it appeared that the market had exhibited the behavior of a discrete aggregate pricing levels analogous to quantum mechanic states. This is, of course a rather foolish moment of paradeia, but as a Physics Professor I many times told my students “If you want to model the trajectory of a cow flying through the air picture the cow is spherical.” Foolish ideas, in Physics quite often lead to very simple truths.

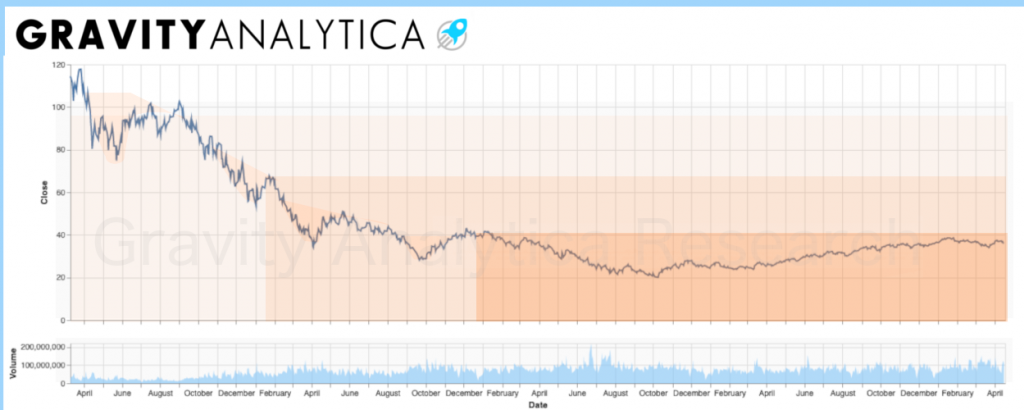

Above is a simple example of how to see the market as a group of energy wells and stable discrete levels. In this example we have chosen to show just three possible locally stable price values.

If the market, could be thought of as just a collection of energetic atoms waveforms added together, then maybe a Ground State could be found for individual stocks? I.e a price at which the stock really can’t (shouldn’t at least) go any lower. At least, that was the hypothesis.

After 5 years of frustration, then two years of live-forward testing in the market we think have an answer.

Yes, we think it can be most stocks.