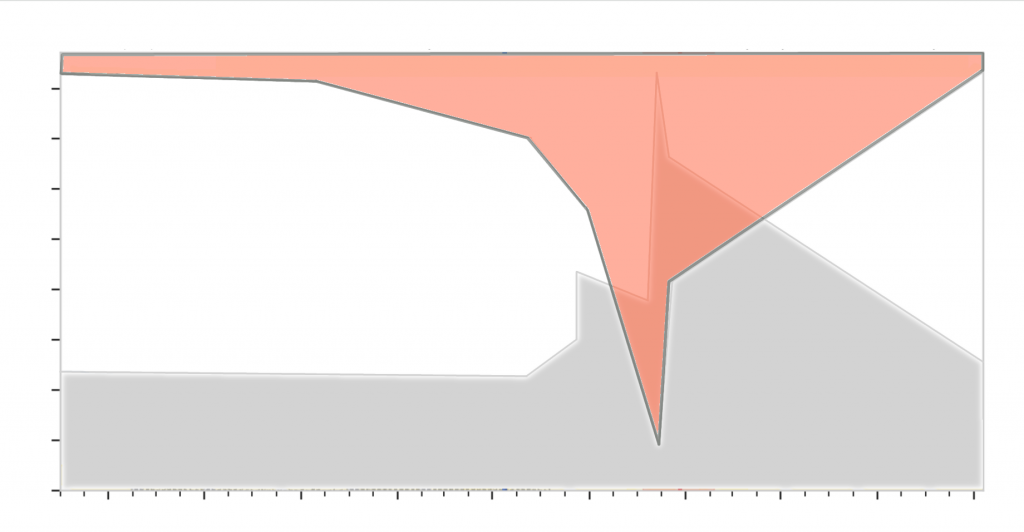

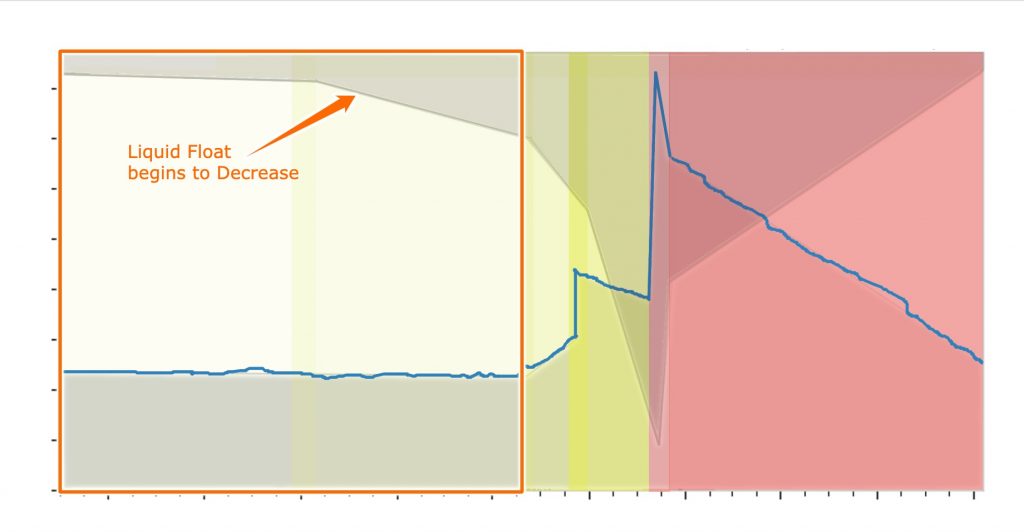

The liquid float is the portion of the float that is actively traded and/or is ready to be traded. It is an unknown quantity. A retail trader will never know what the liquid float is. Shares can become taken off the market without any volume signature. The reported float is a combination of the liquid and hidden float. The hidden float is tightly held shares, by professional traders, chat rooms, etc. that is partitioned between accounts in percentages not requiring declaration. The hidden part of the float is shown in orange here. You can see how the liquid float (the part remaining) changes during the distribution event.

The first step in any distribution, whether a corporate action (dilution) or a independent/third-party pump-and-dump is to restrict the liquid float.

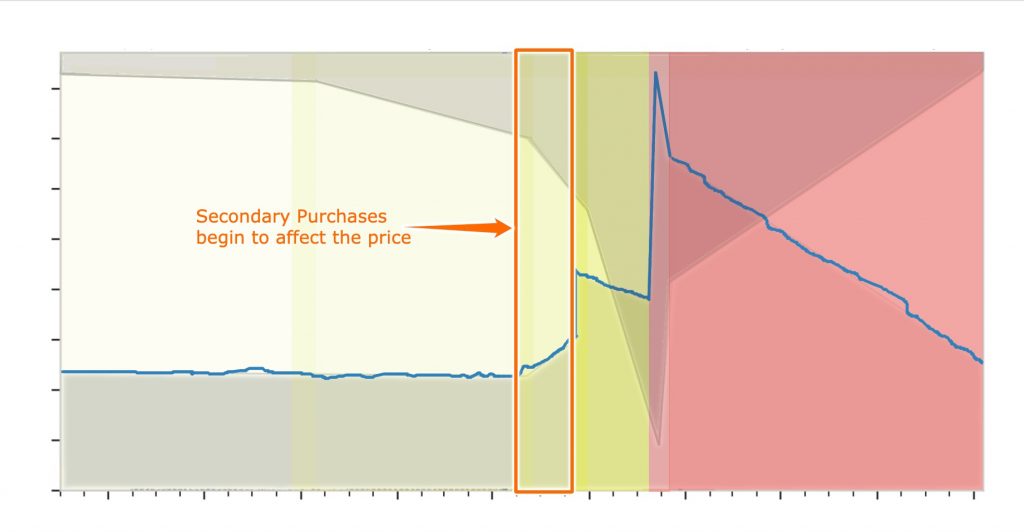

Next the accumulation of shares increases causing a noticeable price change. This can be the same market participants accumulating for months just in a more accelerated manner, or through secondary participants. In the 1980s this was boiler room time period. Now, this is premium chat room members, etc.

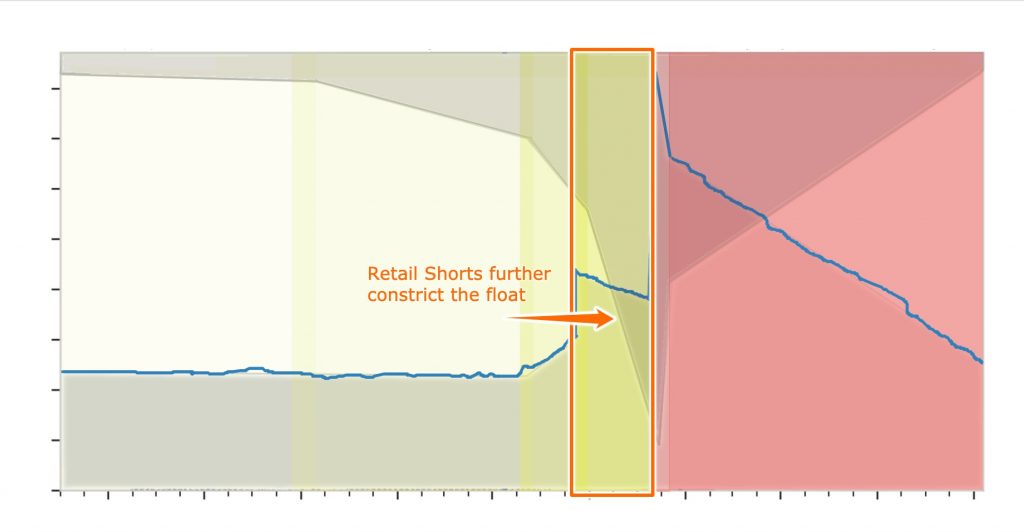

The next part may or may not be successful. This step may repeat many times. The stock will move upwards for any number of reasons, a stock pump, volume event, etc. This move is to attract retail shorts and day-traders attracted to volume. This serves two purposes it raises the average per-share cost and further decreases the liquid float. In an ideal case after numerous cycles the liquid float can become negative. In the graphic the liquid float approaches but does not reach zero shares.

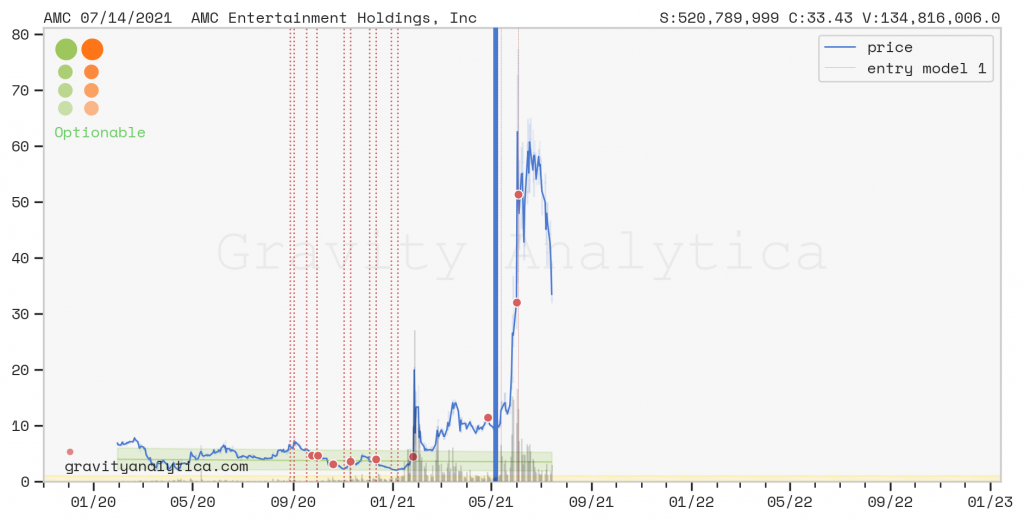

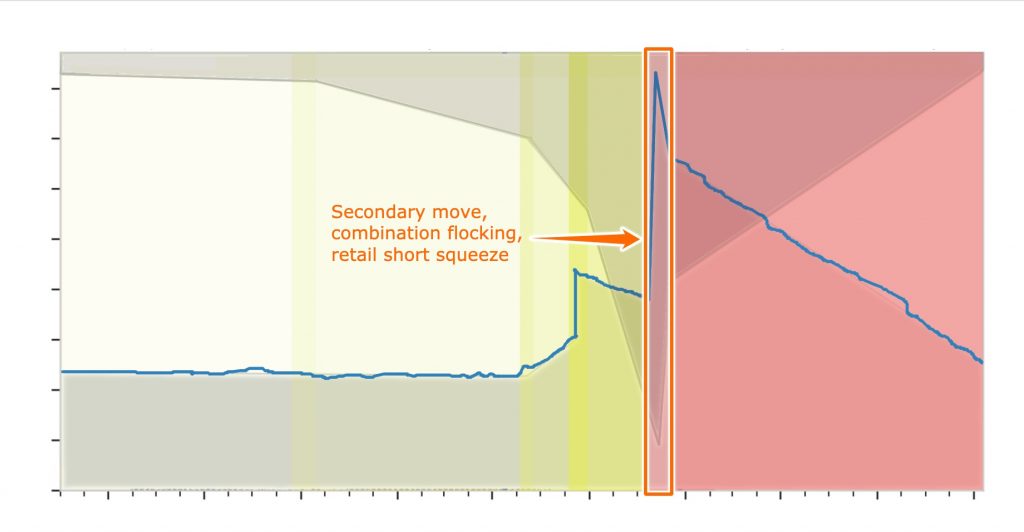

At some point (this can take days or months) the stock will be so illiquid any new volume will force a rapid price movement. As the stock moves upward trapped shorts will cover, new long-side retail traders will flock in as will new retail shorts. This will drive the stock price up. Distribution may start in this move but the distribution event will not be concluded in the spike. The goal is not always to distribute shares immediately, but slowly in the chop and churn that follows. For dilution events that are direct-to-market the number of shares issued will depend on how constricted the liquid float was before the event. Sometimes the shares are registered at the time of the offering sometimes the shelf will be active prior to the move.

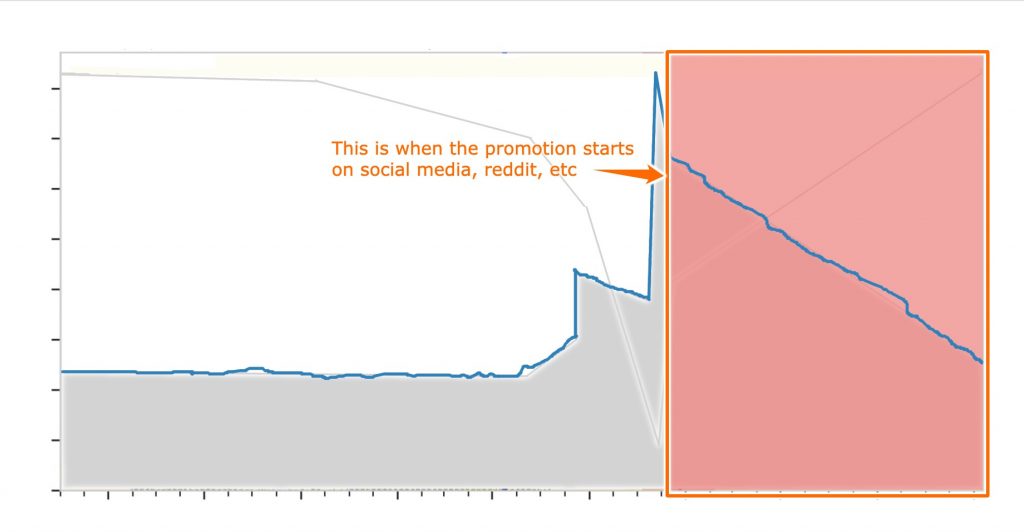

Since the retail per-share cost is considerably higher than the participants distributing shares retail will tend to hold long-enough to liquidate. This distribution takes weeks or months. and may occur in one large move or many small and quick events. For large dollar-volume distributions, if the share price becomes depressed too much the distribution will stop allowing for a follow-up short-trap. For small dollar-volume events, the entire cycle can occur in one premarket/market trading day.

Public stock promotion occurs during or after the distribution. This includes social media activity.

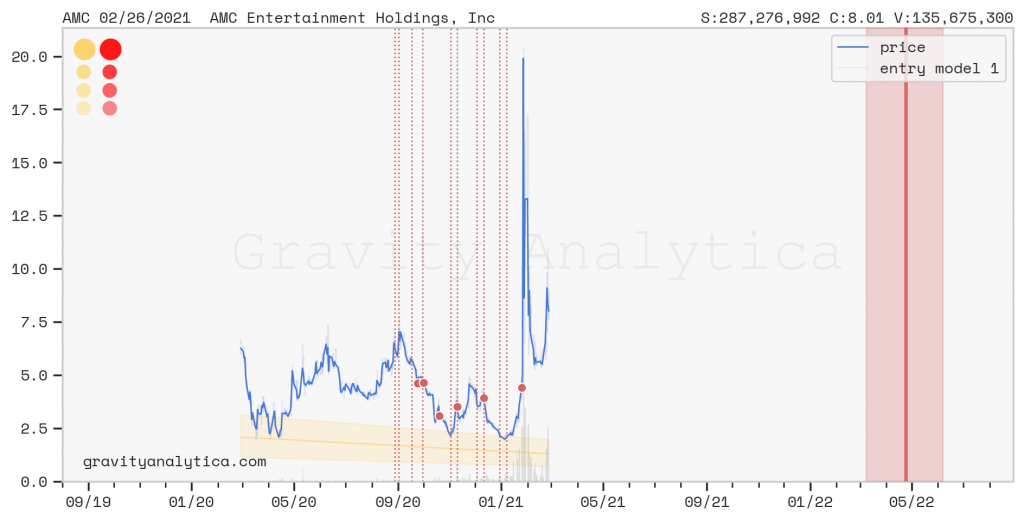

In the case of a distribution that is simultaneously dilution, like what occurred with $AMC the shelf activity is delineated on the risk chart. This increases the total float to a level higher than before the accumulation phase. You can estimate this increase by monitoring the outstanding share volume change. For $AMC an additional 300 million shares where added to the float.