What does EM Model mean?

“EM” means “Entry Model”. So EM Model means Entry Model Model. Not the best choice of a name. But, Risk-Aware Theoretical Ground State Pricing Model (RATGSPM) isn’t easy to remember. See more terms in our glossary

Does the model only work on Penny Stocks?

No. Though it is tuned for emerging market companies. During panics and corrections blue-chip and value stocks will enter the bands as can be seen here for General Motors during the 2020 COVID-19 panic.

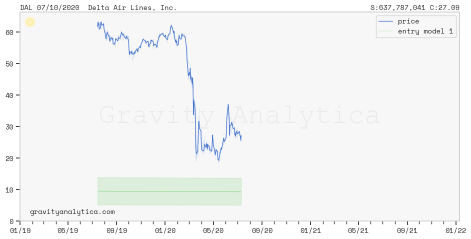

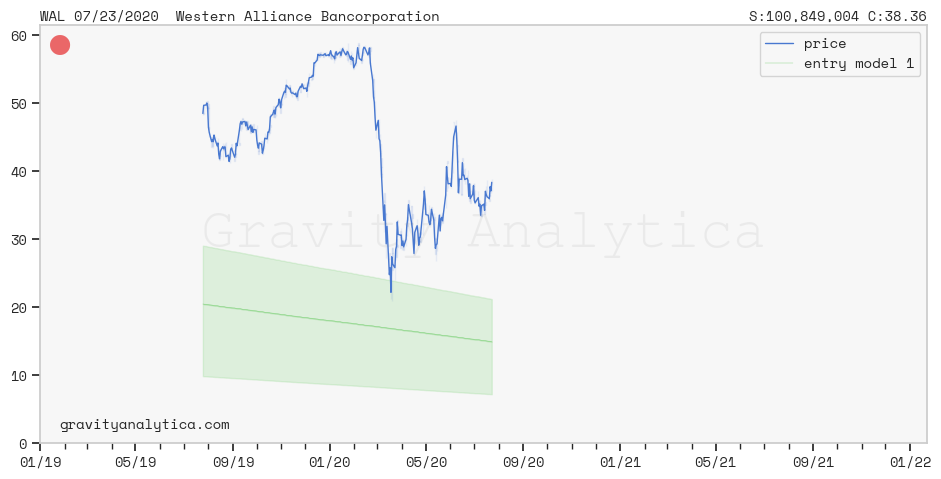

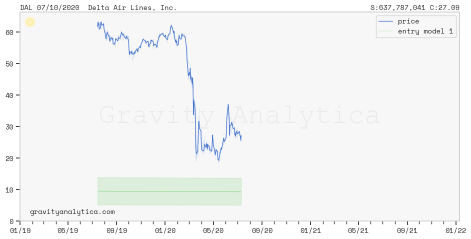

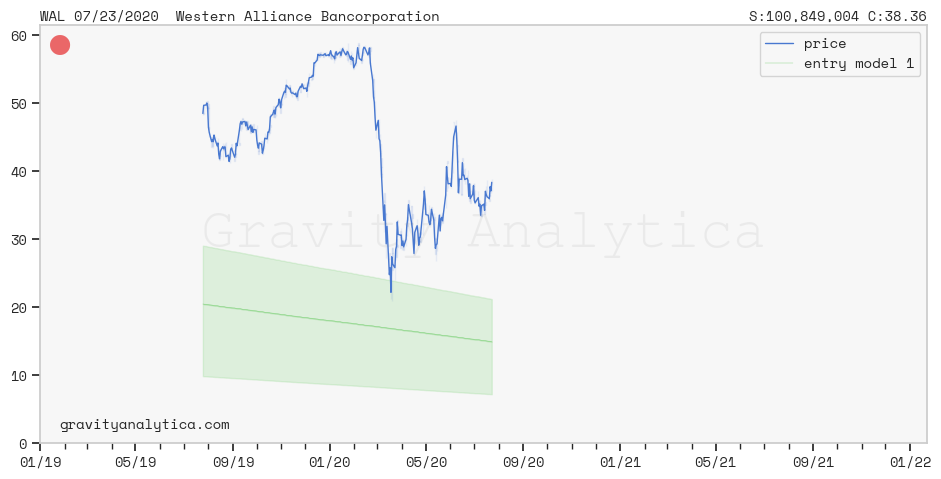

For other companies, the model can be used for relative risk calculations. As you can see here WAL recovered faster and more sharply than DAL in 2020 as it dipped farther into the bands.

For other companies, the model can be used for relative risk calculations. As you can see here WAL recovered faster and more sharply than DAL in 2020 as it dipped farther into the bands.

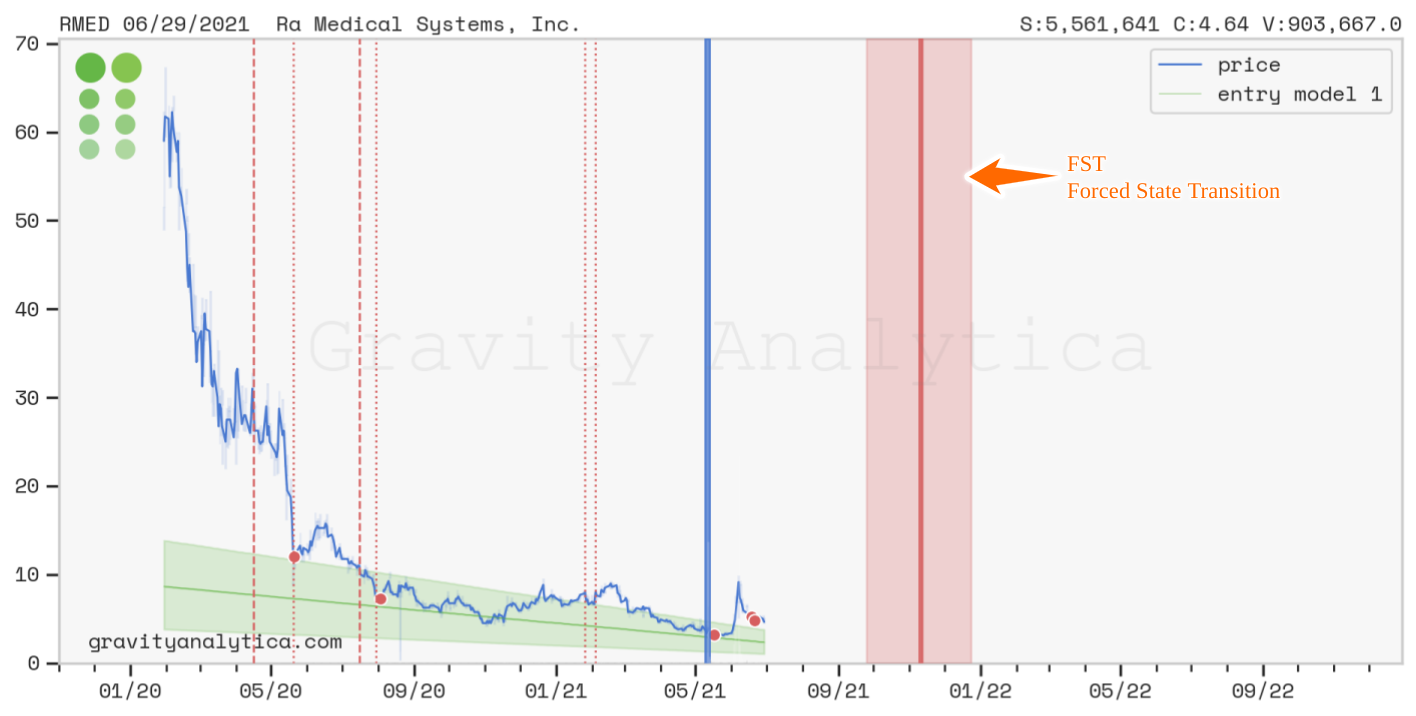

What is the red bar on the chart? What is an FST?

We look at companies as ongoing dynamic state-based physical systems (think chemistry experiments.) There are moments in experiments where something has to give leading to a transition. In your college Chemistry Lab it is that moment when the solution turns blue or explodes. Companies have state transitions as well, usually corporate actions (merger, shelf offering, bankruptcy, etc) or systemic risk event (reverse split, delisting, etc) which may or may not be disclosed beforehand.

Forced State Transitions (FSTs) are the predicted most-probable date that such an action has to occur based on the current state of the company. They are “red” to indicate trading in or around these events incurs added risk as when companies change state this often is accompanied by volume indicative of dilution or distribution.

If you are making money trading then Why do this project?

Many of our friends and neighbors watched their 401k and retirement accounts dwindle during the Financial Crisis. When Wall St makes mistakes, Main St can lose decades of wealth. We aren’t naive enough to believe we can or even claim to be trying to disrupt the institution that is Wall St with its “investment” banks and brokerage “houses.” But, after doing the math we came to the conclusion that offering the models we use to retail traders via subscription does not significantly risk or alter our personal expected returns. So, whereas we don’t believe we can disrupt Wall St, we can at least give it a shot. And, we did the hard work already. How difficult is building a portal to the code base?

Can subscribers see the bots’ trades?

Yes. The bots record their trades near-real time to Chat in the channel ~bots.

How long have you tested the model?

A version of the model has been in use since 2015. We have been posting results publicly since November 2018 on Twitter.

If I ask really nicely will you tell me how the models work?

We trained really intelligent pigeons… I’ve said too much.

Can the bots trade my account?

Not currently.

I have another question how can I contact you?

Email us.

How long have you traded?

AJ made his first trade in 1999 or early 2000. Shaun since 2012.

What happened to the bot Widget?

Widget is semi-retired at the moment. His code base was used to create Sera and Veronica.