The first step in due diligence is also the most important; and the step most likely to be skipped over by investors/traders. Most don’t even know this step is part of the process.

Step 1 – Ask the question: How did I learn about this company?

If you are in the grocery and see a product on an endcap and purchase that item, somewhere out there a marketer is very happy. The manufacturer of that product is also very happy. The store is very happy. But, most likely, had you walked to the aisle of the store that sold similar products you’d be annoyed as you probably paid too much, or bad a new untested product, or bought something about to be over it’s shelf life.

In the modern world, there are very few organic ways to find out about a product. We are constantly advertised to. Most everything in our homes is there because of marketing. We just don’t realize it. It is very unusual for a person to have a problem and discover a product by looking for it free of market place manipulation. One case of this is when your toilet breaks. Toilet manufacturers don’t need to market to you. Their products are necessary. They just have to wait for you to need a new one.

Even if you think you found a product through word-of-mouth someone in that chain most likely saw a well placed Ad. You could be one or one hundred people removed from that Ad. And, during that time the manufacturer might have realized it can charge more and still meet demand.

We went to NASDAQ Trader’s FTP service and downloaded the latest symbol table and using Python randomly pulled five symbols just as an basis. Here they are unformatted.

- INTG|The Intergroup Corporation – Common Stock|S|N|N|100|N|N

- APVO|Aptevo Therapeutics Inc. – Common Stock|S|N|N|100|N|N

- TRA|Yatra Online, Inc. – Ordinary Shares|S|N|N|100|N|N

- FLL|Full House Resorts, Inc. – Common Stock|S|N|N|100|N|N

- SGBX|SG Blocks, Inc. – Common Stock|S|N|N|100|N|N

How many of those companies have you heard about? How did you hear about them? If you haven’t heard of any of them and Google them, what is the top link to appear? A stock promotion? Or product review? A corporate website?

Back to the grocery store. Let’s say you are in an aisle looking for a new cereal and someone tells you that cereal A on the bottom shelf is absolutely the best. Would you buy it? Surely, if a person likes a product enough to evangelize it to a random stranger that is a good sign of quality, right? If you purchase the product love it would the realization that the person who recommended it to you worked for the manufacturer matter? What if you hated it? Your experience with the product matters significantly to your perception of the person in the grocery. You most likely will never know if it was an honest recommendation. Or not. Marketing and product promotion is often presented in a manner that appears sincere; but isn’t.

Remember, stock is just a product the company is selling or already sold to someone else who is trying to sell it. Every mention of a stock symbol, every article, every recommendation, every TV spot, is a promotion. The fact is if everyone is buying and no one is selling, you will never hear about a company unless you go looking for a solution to a problem. If you learned about the company by looking for a solution to a problem you can skip ahead to Step X.

If you except that you are being manipulated then you can realize that what really matters is where you are in this information chain. You should keep this in mind before you start any due diligence. An honest understanding of your place in line can make all the difference in whether a trade or investment is profitable. To phrase this a different way, how many people knew – before you? This is Step 2 and it requires you to evaluate the promotion from which you learned about the company.

Step 2 – How to evaluate the promotion?

Recently, this Ad appeared on cnn.com and it seems as good an example as any so we will use this company going forward which requires a disclaimer*.

* Nothing in this article should be construed as a recommendation for any company’s products or stock mentioned in this article. We do not own any stock mentioned in this article nor have any affiliation with the companies.

**And we were quite confused as to why I was targeted for this ad. Since, I don’t smoke.

The above is an ad for a product. Here is an ad not for a product line or a company but for a stock symbol $DIDI. It is a safe assumption the someone is trying to sell DiDi Global Inc’s stock shares. Learning about a stock symbol before knowing the company name or what the company’s product line is, is something to note as it is direct stock promotion.

After learning about a new company first thing to due after you have answered the question in Step 1 is to go to Google and search for the product/company/stock you recently learned about. In this it is the product “Daily High Club” (with quotes).

The first return from Google is the product website followed by the products Twitter account. This is what you would expect for a product. If the first return is stock blog or social media board that is something to note.

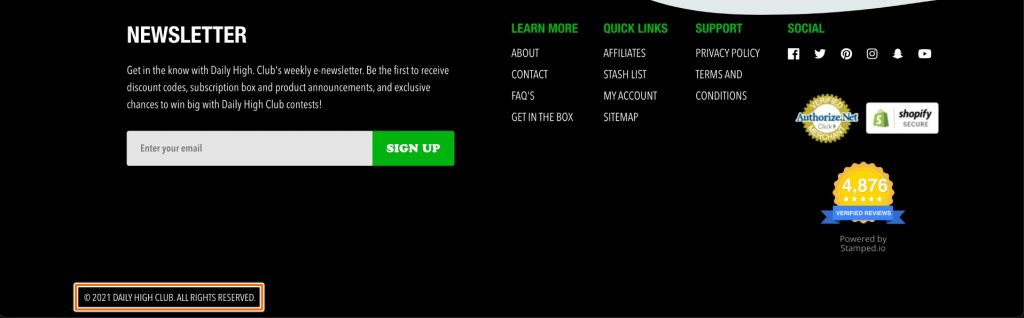

A simple thing to do while examining the product (and corporate) website is to verify the copyright date is current, or at least recent. It is acceptable for a company to not change the date for a few weeks into a new year but if the Copyright date is 2017 that is something to note.

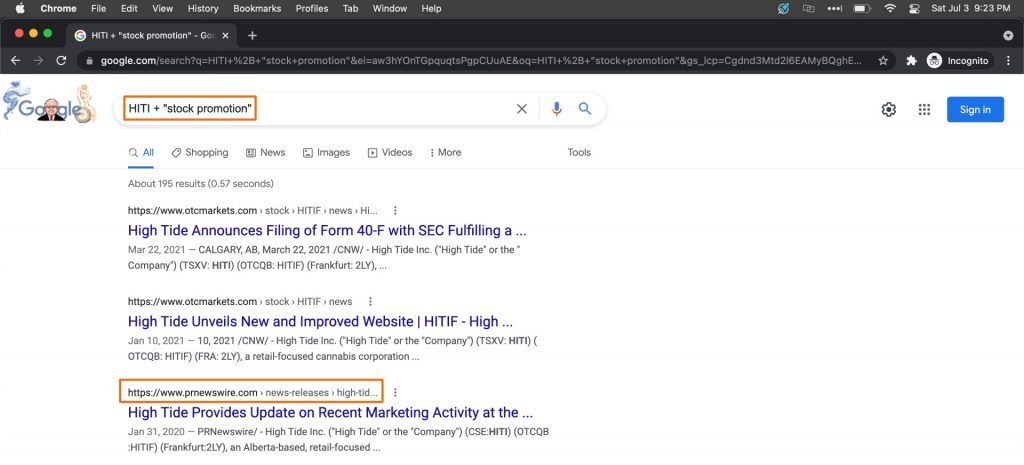

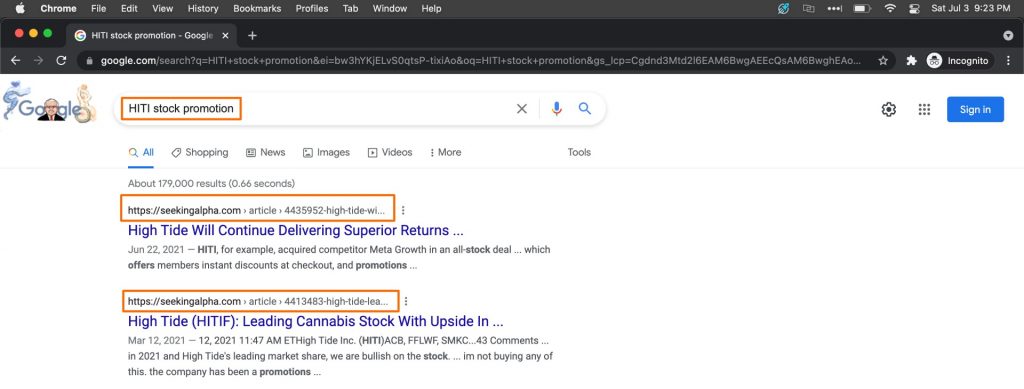

The next thing to do, still on Google is to search for any stock promotions related to the company. You want to do a literal and interpretive search. All stocks will return results but the nature of these results is something to note.

The literal search returns a press release from the company discussing “Recent Marketing Activity” which is something you should explore further and this reveals the first warning flag.

High Tide paid Native Ads Inc. ("Native Ads") for the creation and distribution of certain marketing materials that were published on January 24. For the amount of twenty-six thousand United States Dollars, Native Ads was engaged to provide digital media content and create awareness of the Company's significant news releases published from January 27-28, as well as to gain insight into the effectiveness of its corporate communications.

The company paid a third-party to promote a previous press release. This is not direct share promotion but is not something scrupulous either.

Doing a native interpretative search on Google returns two recent Seeking Alpha articles. Examining the first article the disclaimer states the author is long the stock.

Disclosure: I am/we are long HITI, FFLWF, MSOS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If the author can be tracked, you should. In this case the author has posted their Twitter profile which shows a very small following. The second article is from a Marijuana evangelist, “Cornerstone Investments” who have stated no position or affiliation. This user can be tracked through Tip Ranks. It is difficult to determine if that author is paid to do sector promotion or is just a professional blogger. The Marijuana sector generates a lot of social media so this author might just be making money (to buy weed) through clicks. Be wary of promotional articles that are from new accounts. Illicit and shady stock promoters will create new accounts every few months/years to try and avoid being tracked.

At this point, we still know almost nothing about the company except that if it is a scam (and by scam we mean a pure share seller) it isn’t an obvious one. We still don’t know where we are in the chain either but we aren’t at the very end. It is time examine the publicly available financial and market information about the company which means we need to query the Analyzer.

Step 3 – Evaluating the Risk/Value.

Oh. That looks horrible.

If you don’t have access to a Risk chart you would need to examine the recent Form 10 and any active Shelf documents and waste a few hours.

Step 4 – Relative Value?

If you really like the company at this point you should compare within the sector. Using Google, or a sector search product, add $HITI and various other marijuana companies into Pathfinder. Here is are the charts for $HITI, $VFF and $JUSHF. High Tide Inc. appears to be in the weakest financial situation and might require a secondary raise.